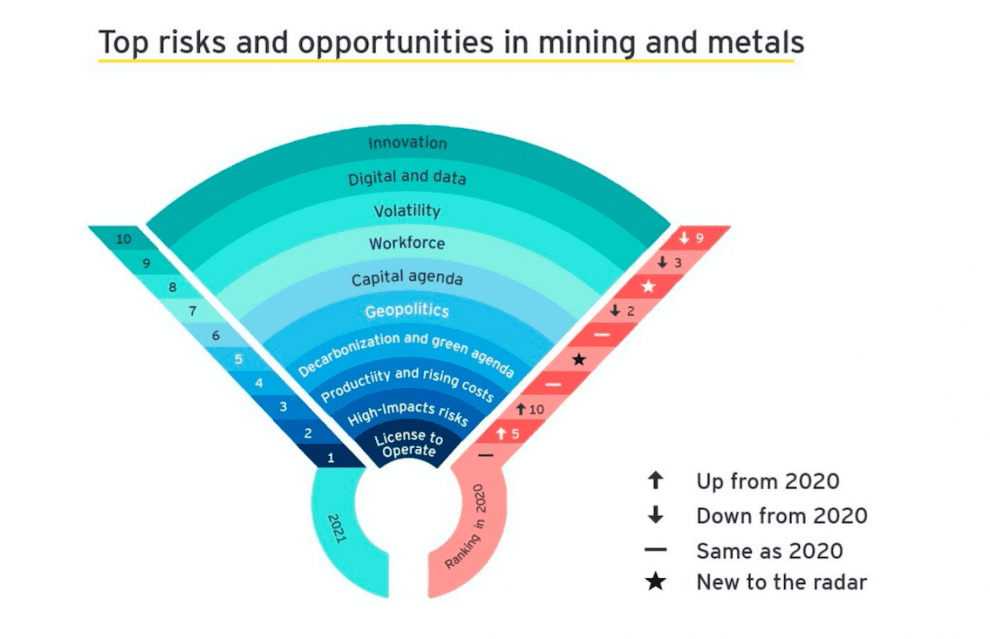

Global mining executives rank license to operate (LTO), high- impact risks, productivity and rising costs as the top three risks facing their business over the next 12 months, according to the Global mining and metals Top 10 Business Risks and Opportunities – 2021. The survey of more than 250 global mining executives’ shortlists the biggest risks shaping the industry, and the reshuffled rank reflect how the pressure COVID-19 pandemic has unexpectedly disrupted commodity demand and prices and prioritised different risks. License to operate, disruption, environment and geopolitical risks are all becoming more prominent as social responsibility and broader stakeholder demands intensify during the current COVID-19 pandemic.

The study highlights the way in which the pandemic has heightened stakeholder expectations around safety, environmental management and corporate responsibility. This is driving the urgency to address external perceptions of the industry, as investors look to understand value beyond the financials.

Paul Mitchell, EY Global Mining & Metals Leader, says:

“The industry has dealt with the impact of the COVID-19 pandemic extremely well, leading a prompt and effective response that allowed many mines to continue operating. However, maintaining business continuity has come at a cost, with mines facing added expenses relating to new procedures and protocols, the introduction of health testing equipment and ensuring that the workforce is supported appropriately. At the same time, the pandemic has heightened stakeholder expectations around how miners prepare for, manage and monitor all high-impact risk exposures.”

Heightened geopolitical risks as economic protectionism grows

Geopolitical issues have become a top of mind concern for mining and metals leaders as the shifting balance of power between the world’s largest economies is changing industry dynamics. The study further highlights concern around how a rise in domestic protectionism in the wake of COVID-19 could affect miners’ ability to operate in key markets.

Mitchell says: “Mining is a global industry and it requires a global mindset to excel. We’ve already seen some governments move to impose tariffs or even export bans to protect domestic producers. Fifty six percent of the survey respondents expect to see royalties and taxes increase as governments seek to raise revenue in response to the pandemic.”

Signs that digital confidence is growing

This year’s survey saw previously prominent issues – including the future of the workforce and digital and data optimisation – fall in the risk ranking (to seventh and ninth respectively).

Mitchell says: “The lower ranking of issues like digital and data optimisation indicates that miners are now more confident in managing these risks. For many, they are considered business as usual, and for others they represent a key opportunity”.

Greater focus on environment and climate can create new opportunities

The study states that while leading companies are laying out their plans to decarbonise operations, for many in the industry, slow or inadequate progress may threaten their ability to access capital in an increasingly tight market. Increased stakeholder scrutiny of corporate behaviour seen during COVID-19 pandemic is likely to continue post-pandemic, with significant implications for how mining and metals companies manage issues surrounding environmental, social and governance (ESG).

Mitchell says: “In a recent EY investor survey, 67% of respondents said that insights from a company’s taskforce on climate-related financial disclosures would play a significant role in their allocation of capital. Companies that strengthen their focus on ESG now can gain a competitive edge in the fight for capital, while transforming their industry for the better.”

Opportunity to accelerate innovation

Innovation features regularly among the top ten risks and opportunities and was placed tenth in this year’s ranking. The study states that companies can broaden the scope and increase the effectiveness of their innovation agenda by building on the rapid pivot response that the industry has already adopted to address the impact of COVID-19.

Mitchell says: “The industry response to COVID-19 is acting as a catalyst to apply more creative, agile solutions to long-standing challenges around health and safety, the cost of energy and engagement with local communities. There is a huge opportunity to remove complexity, overcome historical obstacles to change, and accelerate a transformation agenda that will create long-term value for individual companies, the entire industry and communities.

Now companies have the opportunity to reflect upon changes and focus on retaining the capabilities that enable agility and preparedness for future events.”

Read more Mining Safety News

Add Comment